Biologics have revolutionized the management of previously intractable diseases, but these treatments usually come with a hefty price tag.

Enter biosimilars.

Biosimilars, just like generic drugs, are cheaper versions of existing medications. And similar to generic drugs, the rise of biosimilars is inevitable with the rising pressure on healthcare costs across the globe and the continuing wave of patent expirations for key biologics.

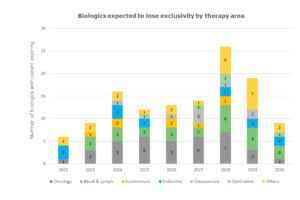

The next eight years will be critical for biologics and biosimilar manufacturers as they prepare to defend and claim market shares.

Biosimilars on growth.

With the loss of exclusivity of so many biologics, the potential demand for biosimilars has created an enormous opportunity for biopharmaceutical companies. However, unlike generic drugs, biosimilars have more challenging hurdles to overcome.

3 top challenges faced by the biosimilar industry.

The three top challenges the biosimilar industry faces are regulatory complexity around interchangeability, the threat of authorized biologics, and new players joining the game.

1. Regulatory complexity around interchangeability. The prescription decision often lies with doctors.

Generic drugs, at their core, are considered exact chemical copies of their originators. Biosimilars are not identical but “highly similar” to the originators and are only perceived as functionally equivalent. The complexity of biological molecules and their production leaves room for minor differences between the originator and biosimilars.

Only a handful of countries have formal regulations on biosimilar interchangeability. Iran and Japan establish interchangeability upon biosimilar approval. The US has additional requirements for interchangeability status, and Australia has a system for a-flagging biosimilars to denote bioequivalence. Most other countries encourage biosimilar use but rely on the decision of prescribers.

So, the biosimilars’ acceptance challenge is two-fold before they can start winning market share: navigating the complex country-specific regulatory situation and convincing prescribers of equivalency.

2. Brand manufacturers expected to compete on the biosimilar price level with authorized biologics.

Originators used this strategy to defend against generic drugs, so authorized biologics could most likely be part of the strategy to protect market share. Authorized biologics are nonbranded copies of the originators; therefore, they are interchangeable, and companies will sell them at a lower price. There are currently no approved authorized biologics, but experts expect them to come into play soon.

Biosimilar companies must prepare for the entry of authorized biologics as a market reaction. The entry of authorized biologics means possibly looking outside pricing and bioequivalence when positioning their products.

3. More biosimilar players catch up with technology and join the game.

The technology to develop and manufacture biologics may be complex, but more and more companies have been able to step up their game in this space. Specifically, we see more and more Asian-based companies expanding outside their countries.

China-based companies are finding their local biosimilars’ market highly competitive, so they are looking to expand outside.

South Korean biosimilar companies, considered among the leaders in R&D for biosimilars, ironically, are facing challenges in increasing biosimilar utilization locally, so they are also looking outside South Korea for expansion.

Aside from the big names like Kyowa Kirin, Shanghai Henlius Biotech, Celltrion, and Samsung Bioepis, we see more Asian companies entering the global market.

India, known to be the largest exporter of generics, also has eyes on the biosimilar market, with Biocon Biologics, a Bengaluru-based subsidiary of Biocon, leading the way.

Are biosimilars the future?

With the expected loss of exclusivity of key biologics this year and in the next few years, the global biologics-biosimilar market will get more dynamic.

Understanding the competitive landscape and conducting a target market analysis will be imperative for companies that want to better prepare for entry.

Originator companies may have learned from their experience with generics and be better prepared for biosimilars. At the same time, biosimilar companies can take measures to even out the odds.

The time for biosimilars is just getting started.

Do you need a partner to discuss how you can remain or be more competitive in your market? Or perhaps you need to obtain more insights on this or other biopharma and healthcare-related topics?

Contact us and gain best-in-class market insights. Learn how we help you make informed decisions.

#biosimilars #healthcareconsulting

Sources:

http://gabi-journal.net/patent-expiry-dates-for-biologicals-2018-update.html

https://www.gabionline.net/reports/Japanese-opportunity-for-biosimilars

https://www.kwm.com/au/en/insights/latest-thinking/biosimilar-use-in-australia-a-status-update.html

https://www.pharmaceutical-technology.com/comment/china-biosimilars-surge-nmpa/

https://mexicobusiness.news/health/news/regulations-needed-boost-mexicos-biosimilars-market

https://www.biosimilardevelopment.com/doc/navigating-brazil-s-emerging-biosimilar-market-0001